It is unusual for a former president of the United States to write a book offering advice to both Congress and the current president on how to fix a problem the nation faces. But Bill Clinton has a habit of ignoring old and meaningless rules.

As we witness gridlock in Washington, the former president’s new best-seller —

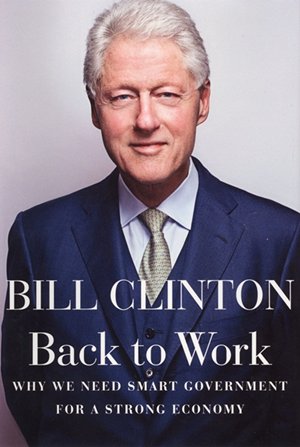

“Back to Work: Why We Need Smart Government for a Strong Economy” — is a most welcome addition to the national debate on the fiscal crisis.

[Editor's Note: To Get Bill Clinton's Book from Amazon – Click Here Now]

.jpeg.aspx?width=200&height=298)

Clinton’s book offers a blueprint from which President Barack Obama and congressional Republicans and Democrats alike could use to get the country working again, even before the 2012 election.

Some Republicans might recoil at the idea of taking advice from a popular Democratic president. In hindsight, many of his most partisan critics admit that Clinton's stewardship over the economy was laudable, offering pro-growth and pro-business policies.

As he details in “Back to Work,” Clinton’s tenure witnessed an economic boom as he controlled the growth of federal spending, slashed capital gains taxes (other taxes were modestly increased), and reduced the federal payroll.

By the time he left office, Clinton had not only balanced the budget, but also left surpluses. When he took office, the national debt had jumped to 49 percent of GDP. When he left, the debt had been reduced to just 39 percent of GDP.

Today that same debt is around 70 percent of GDP and growing — a number that ominously pulsates the word “danger" in red.

President Clinton succeeded because he was adept at using the system the Founding Fathers had created, with compromise being a core principle. He worked with then-House Speaker Newt Gingrich and congressional Republicans to forge programs that made the country stronger. For example, he signed into law the most sweeping welfare reform law in history. There are significant lessons here for President Obama.

In “Back to Work,” Clinton criticizes Republicans for not allowing taxes to be consistent with their spending programs. It’s a fair point, though I still believe we have a spending problem and not a revenue problem.

He says that President George W. Bush spent furiously while cutting taxes, with little complaint from Republicans. A rather interesting chart on page 38 details that Obama’s current spending and projected spending have him adding $1.44 trillion in new spending over eight years. The chart shows that President Bush’s budgets actually increased spending by an incredible $8 trillion over two terms.

For sure, it’s hard to affix party labels to out-of-control government spending.

Spending was not the immediate cause of the current economic crisis, Clinton argues. Instead the meltdown was precipitated because banks were “overleveraged with too many risky investments, especially in subprime mortgages and the securities and derivatives that were spun out of them, and too little cash to cover the risks.”

Further, he suggests that “an anti-government obsession” caused a lax regulatory environment that allowed banks and financial institutions to engage in such risky practices.

On this point I would disagree. Like most conservatives, I believe in sensible government regulation, especially in the banking industry. I believe the real culprit was special interests in Washington — not only Fannie Mae and Freddie Mac, who spent millions lobbying Congress, but the whole financial industry, which has succeeded beyond imagination in setting lax constraints on lending practices.

Take for example, the no-money-down mortgages, the zero-interest mortgages, and the widely used adjustable rate mortgages — all of which I believe were principal triggers for the 2008 meltdown as these mortgages reset to higher rates. Such mortgage schemes are gimmicks that encourage homebuyers to purchase above their means.

Such is the influence of the financial industry today. Many of these mortgage instruments are still legal, though they should have been banned long ago.

Clinton continually points out that he is “not an ideologue but prefers to focus on what works,” especially preferring programs with empirical evidence of success.

One of the reasons I embrace a low tax, less government approach is that I believe it does works and the empirical evidence is there to prove it.

For decades, all over the world, it has been consistently demonstrated that those countries that have low tax rates with less government as a percent of GDP, will have higher economic growth rates. And it is a truism that countries that have high tax rates and high regulatory environments have lower growth rates. There are some exceptions, usually a Scandinavian country or an emerging nation like Brazil, which heavily benefit from commodity sales and can still raise taxes with impunity.

Clinton clearly grasps the idea that government is not the solution. His book emphasizes what he calls “smart government” which, in his view, means that government works with the private sector to get things done.

The Clinton Foundation, which President Clinton founded, helps the neediest in the world in over 180 countries. It has done amazing work because the foundation leverages government to allow the private sector to do what it does best.

Clinton would like to mimic that success with the U.S. government. He says, for example, that U.S. healthcare costs have soared, now amounting to over 17 percent of GDP. No other country in the world spends on healthcare like we do. He notes that if government worked with the private sector and we spent closer to 12 percent on GDP like France does, we could save at least $870 billion overnight.

Clinton’s smart government program is outlined in 46 actionable items. Republicans and Democrats would agree on over 90 percent of them. He believes that the way to fix the U.S. economy is to first fix the current mortgage crisis, which continues to drag the overall economy.

He calls for such things as renegotiating mortgage principal with people struggling to pay their mortgage, lowering interest rates, refinancing, and other incentives to get home ownership back on track. He’s right on this score.

But there are other ideas that he likes including bringing corporate cash offshore back into the U.S. with certain tax benefits and incentives to create new jobs. He wants to speed up the process by which infrastructure programs are implemented.

And he has actionable ways that we can increase exports and create consumer demand here in the United States. Interestingly enough, 15 of his 46 points deal with reducing the cost of energy while improving the environment. This is a laudable goal and very crucial to economic recovery.

Currently oil is $100 per barrel. Just seven years ago, it was around $25 per barrel. And during Clinton’s presidency it was as low as $17 a barrel.

The high cost of oil is wreaking havoc across almost every economic sector. If oil prices were to be cut, it would be like a global tax cut, freeing up consumer cash and exploding economies around the world. Clinton has excellent ideas to reduce oil consumption. As we do so, demand and prices will fall.

His ideas include government efforts to support biofuels, geothermal energy projects, hybrid cars, and improving our national electric grid system so we can use wind and solar power more efficiently.

Former presidents usually spend their time on corporate boards, the speaking circuit and, of course, the golf course. Clinton has chosen a different path and decided to remain part of the national conversation. His book is an important contribution and well worth reading, even for the current occupant of 1600 Pennsylvania Ave.

[Editor's Note: To Get Bill Clinton's Book from Amazon – Click Here Now]

© 2026 Newsmax. All rights reserved.