While the Wall Street "experts" continue to debate where the U.S. economy is headed, we'll continue to focus on helping you to make money.

So, today I'll review some recent economic data and give you an idea of how you can use this data to both protect your portfolio and to grow your wealth - even during stagflation environments. (Stagflation refers to an unusual situation in which a country's economic growth slows considerably at the same time that inflation rises.)

Normally, when economic growth slows, the prices of goods and services tends to fall as a result of declining demand — consumers and businesses alike tend to cut back on their purchases of all types of goods when economic growth slows. But, due to central bankers' inability to control the type of inflation that is caused by significant increases in the prices of goods for which there are few substitutes (i.e. oil and gasoline, food, steel), inflation can sometimes continue to rise even after a country's economic growth has stalled. And, this is exactly the type of situation the U.S. is currently facing.

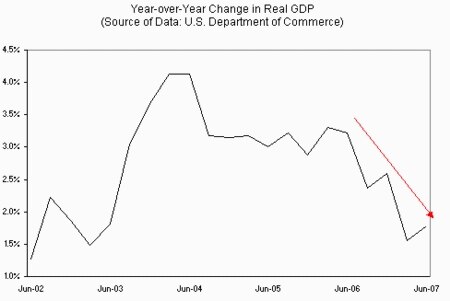

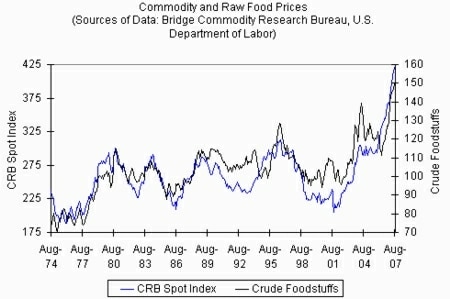

For several months now, my colleague John Browne and I have been warning our readers about slowing economic growth in the U.S., accompanied by rising inflationary pressures — Stagflation. Yet, the Wall Street "experts" have continued to state that the economy is in good shape and that inflation remains under control. But, can see in the charts below that the U.S. economy is clearly not in good shape, as economic growth has slowed significantly while commodity and food prices have risen.

With economic growth in China and other emerging economies continuing to rise at historic rates, there's a good chance commodity and food prices will also continue to rise over the coming months.

Meanwhile, with the U.S. now experiencing job losses and consumer spending continuing to slow, there's a good chance economic growth in the U.S. will continue to decelerate.

The Federal Reserve is well aware of the developing stagflation environment, but is likely more concerned (at this time) about the ongoing credit crunch and the potential for the economy to fall into a recession. As a result, the Fed will likely cut short-term interest rates next Tuesday.

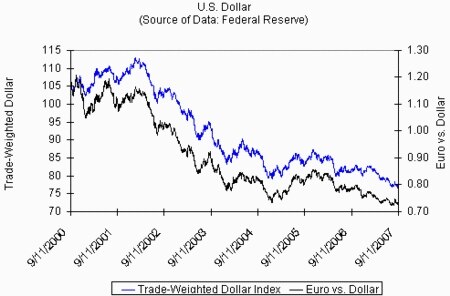

And guess what! Although Wall Street analysts may have their agendas, they're certainly not dumb. Quite the contrary, most of these folks are quite smart. So, they've been bidding up the price of hard assets, such as gold, as the purchasing power of the U.S. dollar continues to plummet. (See the chart below).

And, in case you didn't think about it, a declining dollar adds to inflationary pressures by making foreign goods more expensive and enabling U.S. producers go increase the prices of their goods and still keep the prices of those products below the prices of similar foreign goods.

But, as I've mentioned in the past, there's no reason for you to worry about these developments, because there are numerous exchange-traded funds (ETF) that enable you to profit from rising inflation, slowing economic growth, and a tumbling dollar.

Many of you have emailed me about a new ETF service we'll soon be launching. If you'd like to get on our VIP list and be one of the first to get an invitation to this new service, please email me at ETFVIP@newsmax.com. Time is of the essence to get on this exclusive list, so be sure to send me an email right away.

© 2026 Newsmax. All rights reserved.