For years, dodging Chinese stocks was a no-brainer. Going forward, I’d argue it’s a huge mistake.

I’ve spent the past few weeks meeting with investors, hedge fund managers, and analysts who know China inside and out. The consensus: DeepSeek, China’s AI model that’s neck and neck with OpenAI’s best, is just the opening salvo. China’s cooking up bigger surprises.

The risk I’ll talk about in this article isn’t a market crash. Rather, it’s a shift that has big US tech companies facing bona fide foreign competitors for the first time this century.

To be clear, Chinese companies still raise red flags. Transparency’s a punchline. You’re never quite sure what’s real. But even if you won’t touch a single mainland stock, you can’t ignore the risk they pose to your portfolio.

- China’s 2 big government changes...

Before diving into China’s tech breakthroughs, let’s talk about its government. It’s still largely a command-and-control economy where the state calls the shots.

However, there are two major changes investors must understand...

Change #1: From concrete to cutting-edge

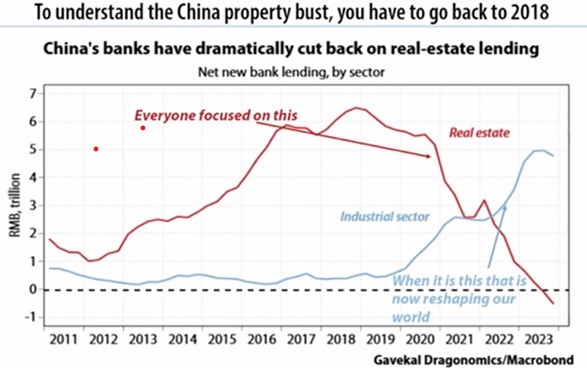

China’s old playbook was simple: pour concrete, build skyscrapers, lay tracks—real estate and infrastructure ruled. That’s why commodities like steel and copper soared in the 2000s.

That all changed in 2018, when US sanctions slammed the brakes on China’s access to cutting-edge chips.

China’s leadership said, “Enough with the old stuff. Let’s build real tech.” It cut funding to property developers and instead started lending money to industry and high tech.

.jpg.aspx;)

Source: Gavekal Research

Change #2: A green light for innovation

For years, the knock on China was that the Communist Party hates tech entrepreneurs. It crushed Alibaba (BABA), fined Tencent Holdings (TCEHY), and cracked down on the broader tech ecosystem.

Beijing isn’t a huge fan of software (apps and cloud computing), but it loves hardware (electric cars, batteries, and drones). And there’s been a huge reembracing of innovators.

Last month, President Xi sat down with around a dozen tech entrepreneurs, including the founders of Alibaba, Huawei, DeepSeek, BYD Company (BYDDY), and Contemporary Amperex Technology (CATL).

In China, symbolism is king. And Xi’s handshake with once-exiled Jack Ma screamed, “Tech’s back.”

As my friend and CIO of hedge fund Three Body Capital David Cunio told me in London recently, “When the state machinery tells you what it wants, we market participants do well to listen. This is a new bull market.”

- Three tech areas where China demands our attention...

DeepSeek shocked markets. But the real bomb will go off the day China drops a chip that’s just a hair off Nvidia’s pace.

As I said, even if you won’t touch Chinese stocks, you can’t ignore the threat they pose to your portfolio. Here are three tech areas where China demands our attention…

#1: EVs and batteries

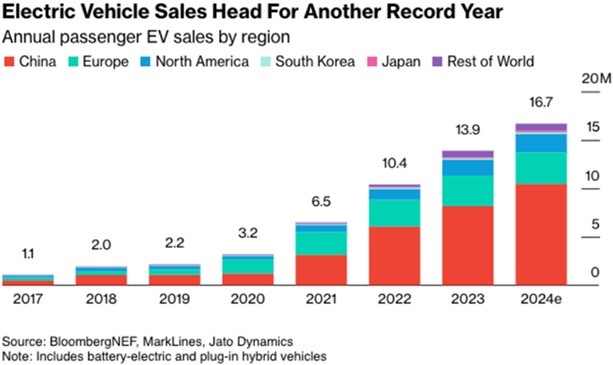

Who’s the king of EVs and batteries? China wears both crowns. BYD snatched the top EV spot in 2024, pumping out 1.77 million cars and edging out Tesla.

CATL, the world’s biggest battery maker, owns 40% of the global market and keeps churning out game-changing tech.

China has the world’s largest EV market, with over 10 million battery-powered cars sold in 2024:

.jpg.aspx;)

Source: Bloomberg

You can measure EV adoption in Chinese cities by counting the license plates. EVs are green; gas is blue. Walk around Beijing or Shanghai, and you’ll notice close to half of all cars are now electric.

A few years ago, there were no Chinese cars on the roads here in Europe. Now, they’re everywhere! BYD just opened a new, flashy showroom five minutes from my house.

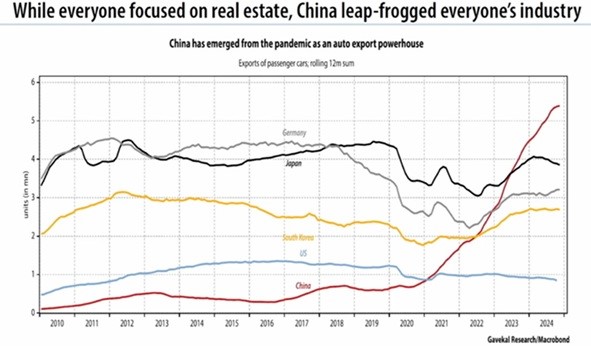

Did you know China now exports more cars than any other country, ever? Talk about leapfrogging your competition.

.jpg.aspx;)

Source: Gavekal Research

It’s fascinating to see China go from “can’t make their own gas cars” to “dominating EVs” in just a short year. The tech tree at work.

BYD even built the world’s largest car carrier ship. Check out the BYD Explorer No. 1 with 5,000 EVs on board:

.jpg.aspx;)

Source: Armazene

“Made in China” used to mean cheap, flimsy goods. Time to update our prior beliefs.

Here in Ireland, BYDs are half the price of a BMW, Tesla, or Volkswagen. They’re also better than any other car I’ve ever sat in.

Everything in the car is voice-controlled. It’s like a giant Alexa on wheels. I don’t just mean playing music, either. You can adjust the height of the steering wheel and set the temperature easily.

Some models have UV-protected sunroofs that block infrared rays, meaning heat is no longer a problem inside the car. Others come with mini fridges. Self-parking features are standard.

I heard Marc Andreessen recently tell a story about Dubai’s royal family replacing its fleet of luxury German SUVs with Chinese cars. I’m pretty sure they didn’t switch because they were strapped for cash. Chinese models are simply superior.

#2: Robotaxis

Sean Maher is one of the smartest and most hard-working analysts I know. He runs Entext Economics. Clients pay top dollar for his research. Sean told me a funny story when I met him in London.

Former UK Chancellor of the Exchequer George Osborne went to China recently and took a robotaxi. After 10 minutes of experiencing a computer perfectly navigating China’s busy roads, his reaction was: “Oh, my god. Autonomous driving is real.”

Baidu (BIDU)—China’s Alphabet (GOOG)—has robotaxis running in 19 cities, with 1,000 vehicles in Wuhan alone. That’s 3X more cars operating in an area 4X the size of Waymo’s San Francisco operations.

Sean toured China for three weeks last year and told me robotaxi company Pony.ai (PONY) is on par with Waymo. It’s also operating self-driving buses with no steering wheel or driver’s cabin. How many investors know this?

I increasingly expect China to roll out robotaxis everywhere before the US. It’s not that Chinese self-driving tech is much better. It’s that authorities are way more tolerant of self-driving accidents.

A Baidu robotaxi hit a pedestrian in Wuhan last month. The local government essentially ignored the story.

We know self-driving cars can save thousands of American lives each year. Problem is, even one robotaxi road death is front-page news.

I don’t want anyone to get hurt. But it seems China decided if you need to hit some people with self-driving cars to save thousands of lives down the road, it’s worth it.

China is “all in” on robotics. Companies like Siasun and Unitree are churning out thousands of affordable, advanced robots each month.

Sean told me China is unmatched when it comes to the pace of iteration. An engineer sketches up a mock design and hands it to a manufacturer in Shenzhen, who’ll have a prototype ready in a few days. That’s a huge advantage in emerging sectors like robotics.

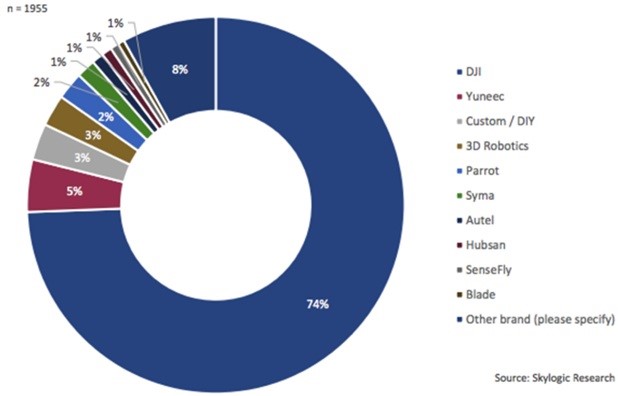

#3: Drones

Drones are the most underrated technology in the world today. They’ll decide wars, as we’re seeing in Ukraine today.

China’s DJI dominates the drone world, controlling 74% of the market:

.jpg.aspx;)

Source: Skylogic Research

DJI makes a drone every minute, seven days a week. Both Ukraine and Russia use Chinese-made drones on the battlefield. Where does the US military get most of its flying robots? You guessed it… DJI.

Even drones made in Europe and America are cobbled together using mostly Chinese parts.

(Note: The US and other countries have started moving away from Chinese drones because of security concerns. When the American Security Drone Act goes into effect in December of this year, it will prohibit the use of federal funds for purchasing or operating drones from China and some other covered countries.)

A former Navy SEAL—who’s legendary in the special forces community—recently told me drones are the biggest disruption to warfare in 1,500 years.

Giant warships were the old way to flex military might. Now, it’s showing off a 10,000-strong drone army. One giant battleship vs. 10,000 kamikaze flying robots. There’s only one winner.

China is way ahead when it comes to flying robots. Check out this Lunar New Year light show. Those are thousands of drones dancing in midair, perfectly in sync:

.jpg.aspx;)

Source: @JimHarris on X

Drones will change our world in so many ways, and they’re not just killing machines.

Within a few years, drones will patrol the skies above every major sporting and public event to keep us safe. They’ll fight forest fires… catch criminals… transform the delivery of everything… and save lives by flying defibrillators to heart attack victims faster than any ambulance.

- My research suggests China could outperform the US over the coming years.

Even if you don’t like that idea, we must be open-minded to the possibility.

While challenges remain, the combination of innovation-driven growth, government support, attractive valuations, and shifting sentiment creates a potent cocktail for potential outperformance.

The risk-reward profile for Chinese stocks is increasingly attractive. China looks like it’s beginning a new bull market. It’s time to explore the opportunity before the narrative fully shifts and the crowd piles in.

In my free eletter The Jolt, I write about today’s biggest disruptions in the market, like what we’re now seeing in China, and the best ways to play them. It’s where innovation meets investing. Here’s how to join.

_______________

Stephen McBride is Chief Analyst, RiskHedge. To get more ideas like this sent straight to your inbox every Monday and Friday, make sure to sign up for The Jolt, a free investment letter focused on profiting from disruption.

© 2026 Newsmax Finance. All rights reserved.