Gold prices were set to end a record-breaking year on a positive note on Tuesday as robust central bank buying, geopolitical uncertainties and monetary policy easing fuelled the safe-haven metal's strongest annual performance since 2010.

Spot gold rose 0.4% to $2,615.00 per ounce as of 0927 GMT, while U.S. gold futures gained 0.4% to $2,627.30.

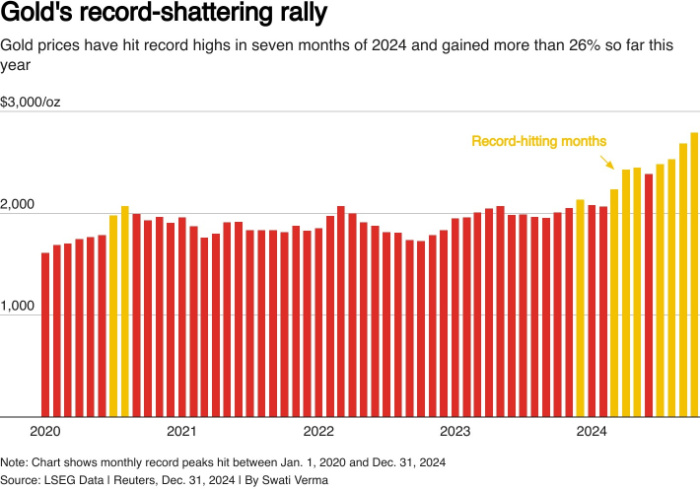

Gold prices have hit record highs in six months and gained about 26% so far this year

As one of the best-performing assets of 2024, bullion has gained more than 26% year-to-date, the biggest annual jump since 2010, and last scaled a record high of $2,790.15 on Oct. 31 after a series of record-breaking rallies throughout the year.

"Rising geopolitical risks, demand from central banks, easing of monetary policy by central banks globally, and the resumption of inflows into gold-linked Exchange Traded Commodities (ETC) were the primary drivers of gold’s rally in 2024," said Aneeka Gupta, director of macroeconomic research at WisdomTree.

The metal is likely to remain supported in 2025 despite some headwinds from a stronger U.S. dollar and a slower pace of easing by the Federal Reserve, Gupta added.

The U.S. Fed delivered a third consecutive interest rate cut this month but flagged fewer rate cuts for 2025.

Donald Trump's incoming administration was also poised to significantly impact global economic policies, encompassing tariffs, deregulation, and tax amendments.

"Bullion bulls may enjoy another stellar year ahead if global geopolitical tensions are ramped up under Trump 2.0, potentially pushing investors towards this time-tested safe haven," said Exinity Group Chief Market Analyst Han Tan.

Stocks closed down Monday on the second-to-last trading day of 2024 - a year in which all three major indexes posted strong double-digit gains.

Bullion is often regarded as a hedge against geopolitical and economic risks and tends to perform well in low-interest-rate environments.

"We expect gold to rally to $3,000/t oz on structurally higher central bank demand and a cyclical and gradual boost to ETF holdings from Fed rate cuts," said Daan Struyven, commodities strategist at Goldman Sachs.

Spot silver was steady at $28.96 per ounce, palladium rose 0.8% to $910.70, and platinum added 0.4% to $904.56.

Silver is headed for its best year since 2020, having added nearly 22% so far. Platinum and palladium are set for annual losses and have dipped over 7% and 17%, respectively.

© 2026 Thomson/Reuters. All rights reserved.