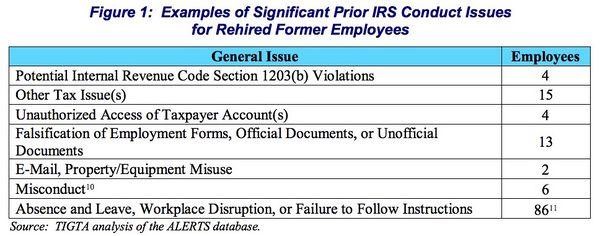

An inspector general’s report found that, between January 2015 and March 2016, the IRS rehired 213 workers who left because of significant misconduct issues. This reflects roughly 10 percent of all the former employees rehired during this time.

The total includes four cases of unauthorized access of taxpayer information and four "had been terminated or resigned for willful failure to properly file their Federal tax returns."Another "rehired employee had several misdemeanors for theft and a felony for possession of a forgery device."

Source: U.S. Department of the Treasury, "The Internal Revenue Service Continues to Rehire Former Employees With Conduct and Performance Issues," July 24, 2017.

This happens because those deciding who to hire are not provided with past IRS employment history. Given "the sensitive nature of taxpayer information handled by IRS employees," the inspector general’s office believes it is “important for the IRS to consider prior conduct and performance issues before making a tentative employment offer."

An earlier inspector general’s report had identified this problem and recommended solutions that would enable the agency to avoid such situations. IRS officials said that they did not implement the recommended reforms because they were "not likely [to] yield a reasonable return on investment." However, the inspector general said that “the IRS was unable to provide documented support for this position."

Scott Rasmussen’s Number of the Day is published by Ballotpedia. Each weekday, Scott Rasmussen’s Number of the Day explores interesting and newsworthy topics at the intersection of culture, politics, and technology.

Scott Rasmussen is a Senior Fellow for the Study of Self-Governance at the King’s College in New York and an Editor-At-Large for Ballotpedia, the Encyclopedia of American Politics. His most recent book, "Politics Has Failed: America Will Not," was published by the Sutherland Institute in May.To read more of his reports — Click Here Now.

© 2026 Newsmax. All rights reserved.